The UK’s first ‘league table’ of leading Master Trusts carbon footprint performance has been published this week, providing valuable information to help Micro, Small and Medium-Sized Enterprises (MSMEs) better understand the carbon impact of their pension scheme. The Master Trusts have £131bn assets under management on behalf of 25 million pensioners.

The UK’s first ‘league table’ of leading Master Trusts carbon footprint performance has been published this week, providing valuable information to help Micro, Small and Medium-Sized Enterprises (MSMEs) better understand the carbon impact of their pension scheme. The Master Trusts have £131bn assets under management on behalf of 25 million pensioners.

Researched by West London Business, the Green Pensions report provides an in- depth review of data taken from the first annual cycle of Task Force on Climate- Related Financial Disclosures (TCFD) reports from 17 leading UK Master Trusts with investments of over £1bn. These include NEST, Legal and General, Aviva and The Pensions Trust.

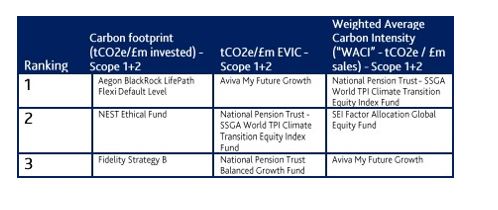

Shining a light on the top three Master Trusts for their green credentials, Aegon BlackRock LifePath Flexi Default Level, NEST Ethical Fund and Fidelity Strategy B were found to top the table for their carbon footprint for Scope 1 and Scope 2 greenhouse gas (GHG) emissions. Aviva My Future Growth, National Pension Trust and SEI also appeared in the top three rankings.

National Pension Trust was found to stand out for their transparency in reporting the top 10 emission intense equities in each of their funds. However, of the 67 funds reviewed across the 17 Master Trusts in the study, only three funds (NEST, NOW: Pensions and Smart Pension) were found to voluntarily report on their Absolute Scope 3 emissions.

A few Master Trusts including Aegon, Aviva, Mercer and Smart Pension were also shown to have started trialling the Implied Temperature Rise (ITR). This provides a forward-looking view of carbon exposure, however a more consistent and reliable reporting approach is needed for this metric to be accurately comparable.

Andrew Dakers, Chief Executive of West London Business, said, “For the first time, the Green Pension Report provides small business decision-makers with a comprehensive breakdown of how their auto-enrolment pension scheme measures up against its peers in relation to carbon. Our findings did reveal however that not all funds met the minimum reporting requirements and there is an urgent need for a more transparent and common approach to TCFD reporting, making it easier for stakeholders to access and interpret the data. Financial performance will continue to be an important part of decision-making however it’s important MSMEs planning their transition to net zero, can also make informed decisions on working with Master Trusts that align with their environmental sustainability goals. We hope this report will help provide a starting point.

“We make a specific recommendation in the report for The Pensions Regulator to ensure that Master Trusts publish the key metrics data in a machine-readable format moving forward, alongside their narrative TCFD reports.”

The Green Pensions report will be repeated by West London Business in Spring / Summer 2024, to assess and share an update on progress in the Master Trusts 2022/23 TCFD reporting cycle.

To find out more, visit https://westlondon.com/wp-content/uploads/2023/09/Green- pensions-How-good-is-your-Master-Trust-Sept-2023-v1.6.pdf

ENDS

For further information or to arrange interviews, please email [email protected]

Notes to Editors:

*This report provides an in-depth review of the metrics disclosures in the first annual cycle of TCFD reports from 17 leading UK Master Trusts with £1bn+ Assets Under Management (AUM). The Master Trusts have £131bn+ under management and 25 million members. The research was initiated by West London Business to give MSMEs planning their transition to net zero on the Better Futures programme a guide to inform this significant element of their payroll-linked expenditure.

Photo Captions

- The UK’s first ‘league table’ of leading Master Trusts carbon footprint performance has been published this week by West London Business

High-res image can be downloaded from https://www.dropbox.com/scl/fi/7yuf7r5e1cojc8hidbsgg/front-view-man-with- wooden-blocks.jpg?rlkey=mdj72v7yfpaduayb0yd7bzsi3&dl=0.

About West London Business:

West London Business (WLB) ensures West London is a successful, inclusive, environment for responsible business. West London is the UK’s global gateway; a £73billion+ GVA economy underpinned by 120,000+ businesses. We are a business- led leadership forum, with members including Heathrow and Amazon Web Services (AWS), as well as key regional firms such as Fuller, Smith & Turner and Bigham’s. WLB has 15,000+ supporters and convenes 30+ events per annum, including the West London Business Awards.

Our members work together through WLB to raise West London’s global economic competitiveness and catalyse action for people and planet. Through our work we inform and influence the work of local, regional, and national government policymakers and promote inward investment.

To find out more, visit www.westlondon.com.

Media contact:

Fiona Anderson, GEC PR

[email protected]